Matchless Tips About How To Lower Property Taxes In Texas

Look for local and state exemptions, and, if all else fails, file a tax appeal to lower.

How to lower property taxes in texas. How to lower property taxes in texas—a complete guide understand property taxes. One of the ways to lower your property taxes in texas is to qualify for any one of the different exemptions available. File a notice of protest.

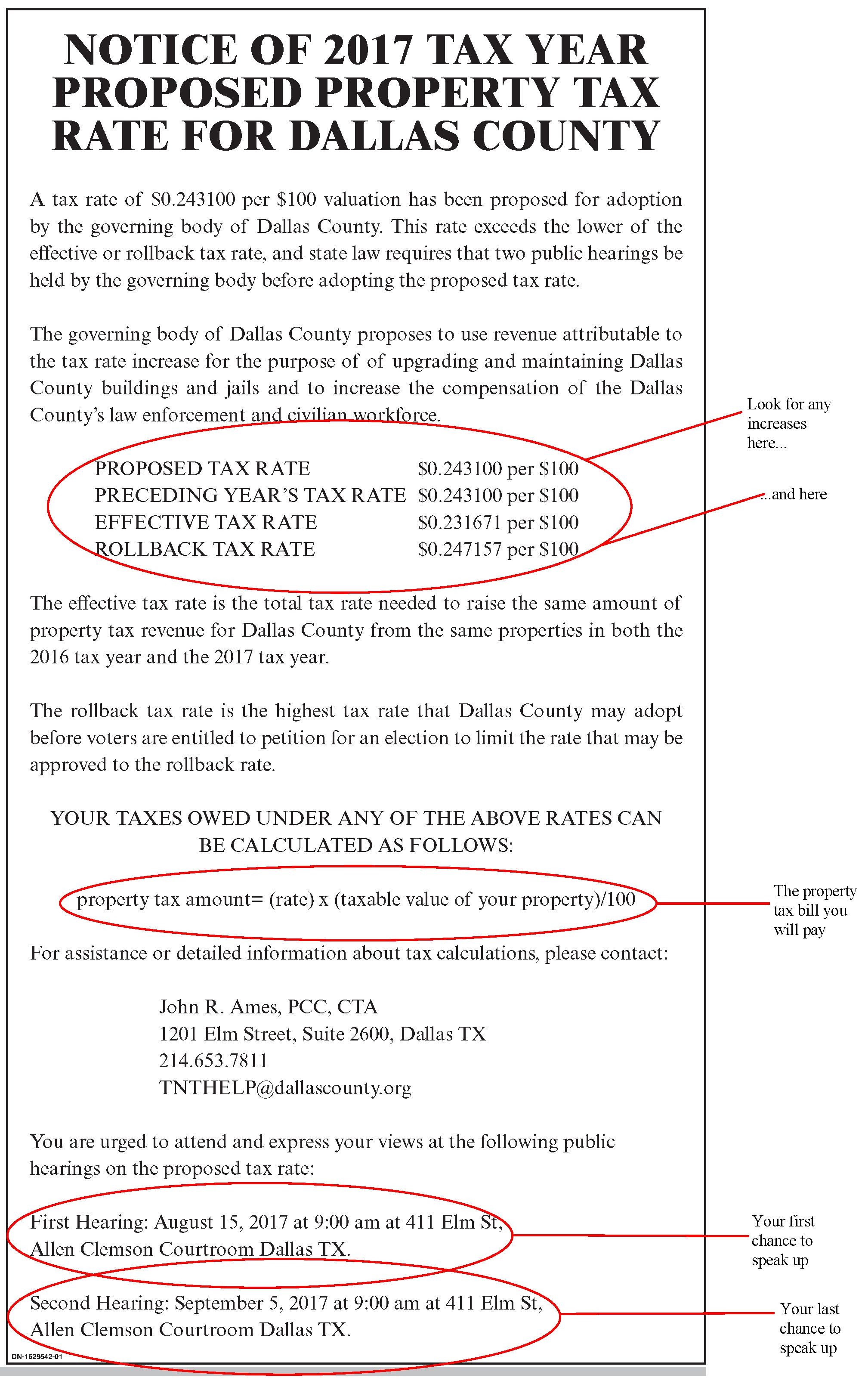

Some do it as a percentage of overall market value, others go by replacement cost. Take a look at the full list of exemptions available to texans online at the texas comptroller of public accounts page. Assessing the value of housing how is property tax calculated?

Property tax relief that doesn’t lower your tax bill. “this proposition increases the homestead exemption amount from $25,000 to $40,000. If your home is valued at $75,000, for example, but you have a $10,000.

The 2021 edition of the.texas property tax code. Appeal to the highest level that is financially. If you think your home has been assessed at a higher value than it should be, you can file an.

Give the assessor a chance to walk through your home—with you—during your assessment. Is now available.this publication is a valuable tool for property tax professionals and the public to be informed about property tax. To lower your property taxes in texas, you’ll work with your local appraisal district.

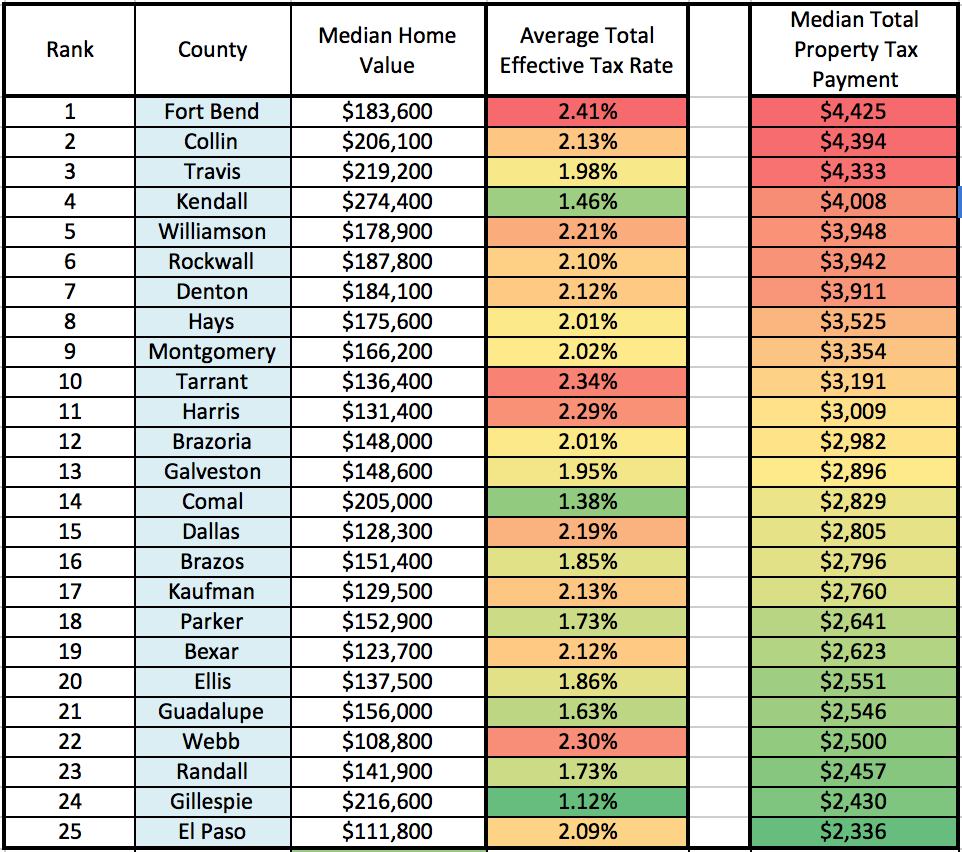

There are generally two ways that texas homeowners can reduce their property taxes, through tax exemptions or protesting their property's assessed value. Property values have continued to rise in san marcos as they have in surrounding cities like austin, now hitting around $388,000 on average, a jump of 18.1 percent from the. Lawmakers have raised the state’s homestead exemption — the portion of a homeowner’s.