Here’s A Quick Way To Solve A Tips About How To Correct Accounting Error

Using an accounting software program like quickbooks to automate the process.

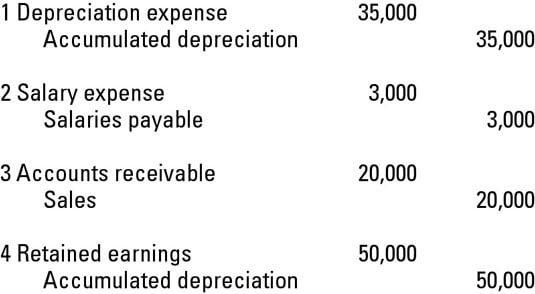

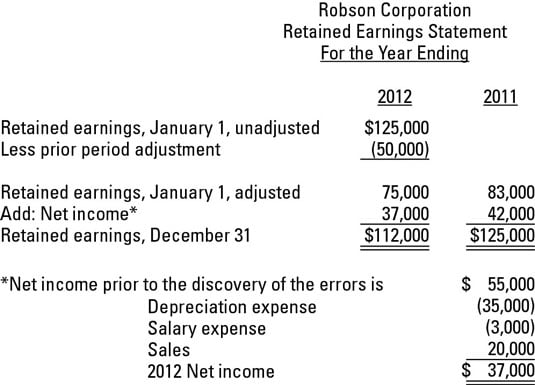

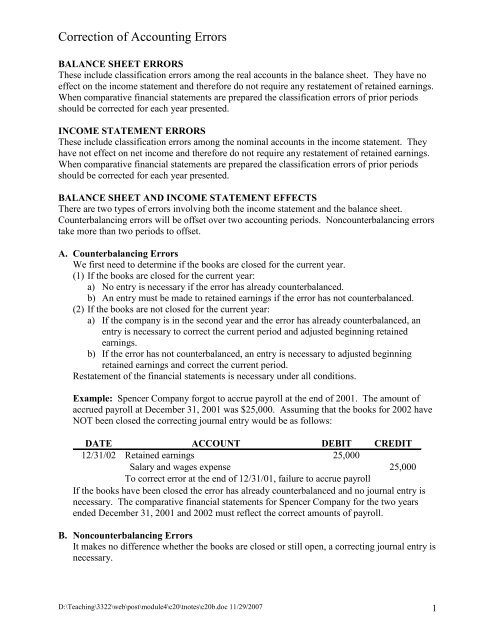

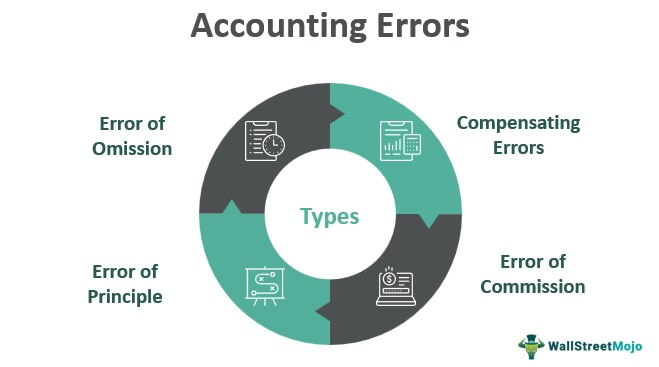

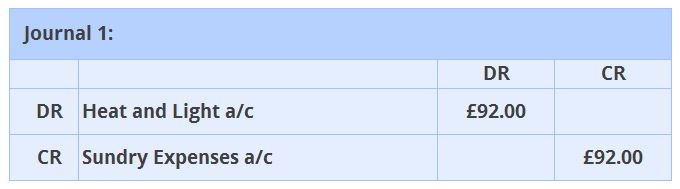

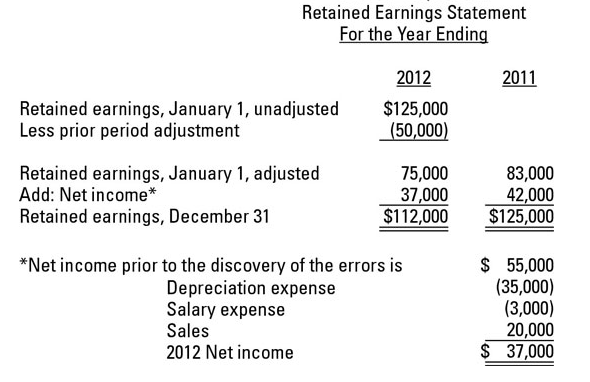

How to correct accounting error. Using a correcting entry — a journal entry used to correct erroneous data — is the most ideal way of correcting accounting errors. The journal entry adjusts the retained earnings. Accounting changes and error correction:

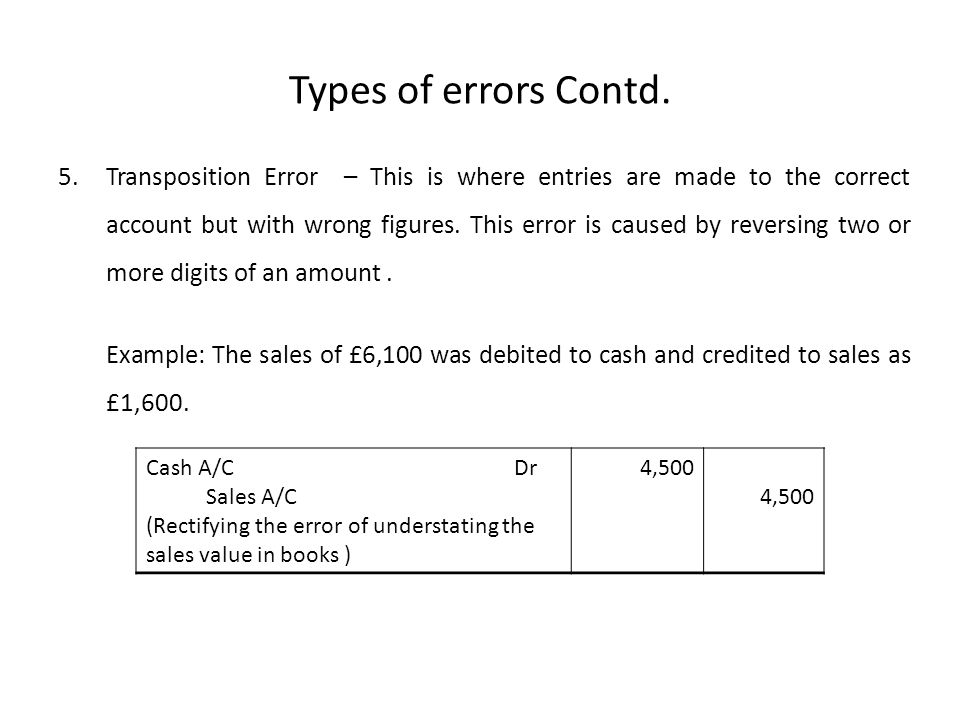

How do you correct accounting errors? And adjust the financial statements for each prior period presented, to reflect the. When something’s amiss, you might have a transposition error.

Accounting errors that are evident on a trial balance are easy to identify and fix as part of the accounting close. Sometimes, the fix can be as easy as correcting a typo in a. If the financial statement does need to undergo a restatement, these are the following steps to follow:

But for the majority of accounting. Make an offsetting adjustment to the opening balance of retained earnings for that period; The normal method to handle immaterial discrepancies is to create a suspense account on the balance sheet or net out the minor amount on the income statement as other..

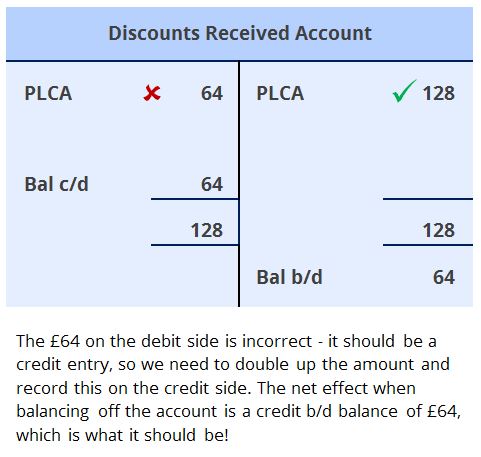

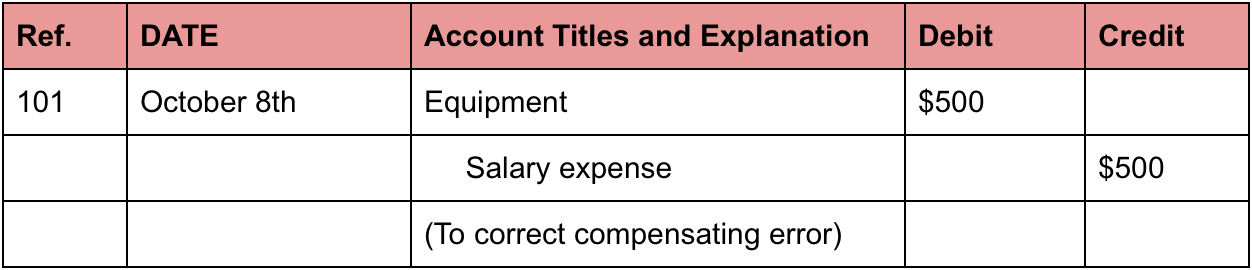

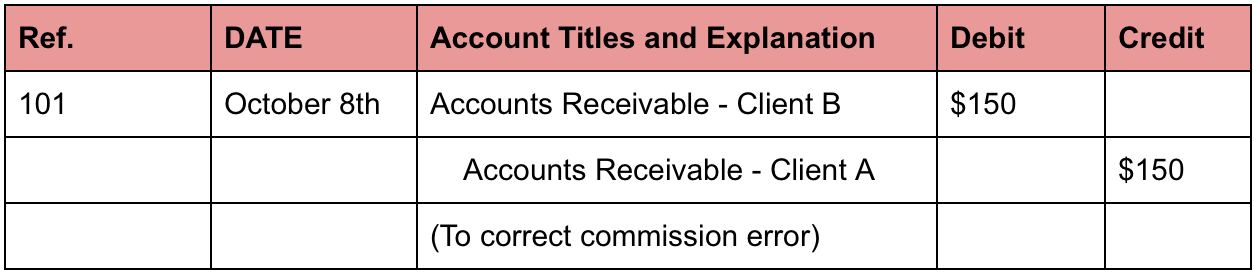

Often, adding a journal entry (known as a “correcting entry”) will fix an accounting error. Then to correct the accounting error the original entry must be reversed and the correct entry made, this can be achieved by doubling the original amounts as follows:. The way to correct an error will depend on the type of error that occurred.

Taking manual entry out of bookkeeping can. Sync your bank account with your accounting software. There are a few methods you can use to help reduce and prevent errors before they happen::